How the Homebuyer Program Works

At Greater Fox Cities Area Habitat for Humanity, we’ve helped hundreds of families through our Homebuyer program. Learn more about this opportunity to own your own home in Neenah by filling out the form below!

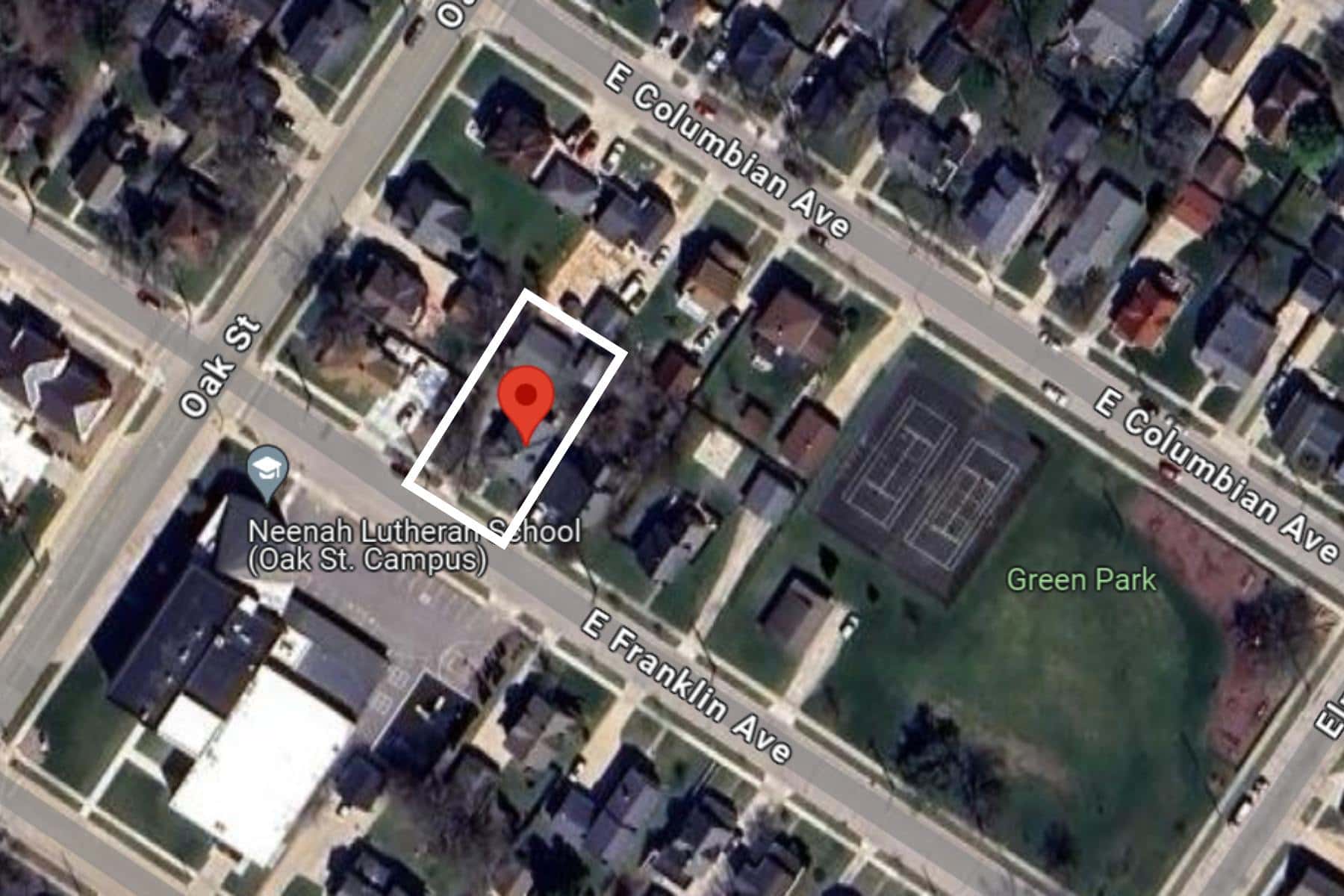

Homebuyer - Neenah

This rehab home is a special opportunity for you to begin your homebuyer process right away and be first in line for a new home! For more information, download the application or fill out the form below.

![]()

![]()

How the Homebuyer Program Works

At Greater Fox Cities Area Habitat for Humanity, we’ve helped hundreds of families through our Homebuyer program. Learn more about this opportunity to own your own home in Neenah by filling out the form below!

Our Homebuyer program makes the dream of homeownership possible for many Fox Cities families. Having a safe, affordable home empowers a family to invest in a more secure future for themselves and their children.

The Homebuyer program allows qualified, low income, hardworking people in the Fox Cities to purchase a home with a 0% interest mortgage loan. Monthly mortgage payments include repayment to Fox Cities Habitat for the home’s principal amount, the property taxes and home insurance.

Not sure if you qualify for the program? Connect with our Almost Home team to make sure you are prepared and eligible for the program.

Homebuyers are required to take educational classes on financial management and home maintenance to prepare families for long-term, sustainable homeownership.

Future homeowners work with a team of professionals and skilled volunteers to participate in the building of their own home.

Fox Cities Habitat families are provided a toolbox of resources and ongoing support to ensure they can keep up with their bills and home maintenance.

Greater Fox Cities Area Habitat for Humanity offers a Homebuyer program to qualified low-income individuals and families in Calumet, Outagamie, Waupaca and Northern Winnebago counties.

Individuals interested in home ownership through Fox Cities Habitat will need to complete and submit an application along with a $55 application fee (one fee per application) when applications cycles are open.

Please review the Homebuyer program applicant guidelines to learn more about the program.

There are times when we have more applicants than homes we can build. We’ve developed a needs-based scoring system that allows us to prioritize families facing the greatest need for affordable, safe housing.

Program applicants must need Fox Cities Habitat housing due to one or more of the following circumstances:

The proposed income guidelines are based on family size. A family’s gross annual income must be at or above the minimum and at or below the maximum to be eligible.

| Family Size | Minimum | Maximum |

| 1 | $44,400 | $58,250 |

| 2 | $45,200 | $66,600 |

| 3 | $50,500 | $74,900 |

| 4 | $50,550 | $83,200 |

| 5 | $50,550 | $89,900 |

| 6 | $50,550 | $96,550 |

| 7 | $52,700 | $103,200 |

| 8 | $54,700 | $109,850 |

| 9 | $58,250 | $116,500 |

| 10 | $61,575 | $123,150 |

As part of the process, Fox Cities Habitat evaluates an applicant’s last two years of household income and debt. Applicants must be comfortable with a monthly mortgage payment set at 25% of their gross monthly income, and have enough income through stable employment, or other forms of permanent income to afford a home and all basic living expenses.

All income sources are included that are expected to last for three years or longer. Income includes all wages, unemployment (only if related to seasonal employment), social security, pension and/or disability. Income can also include child support, kinship care and other types of income received on a regular basis. Self-employment income is defined as the net profit. To accurately calculate your income, use this income calculator.

An applicant’s credit history does not need to be perfect. In fact, many applicants have some debt. It is important to know how much is owed and for the total amount of debt to be manageable. It is recommended that applicants obtain a free copy of their credit report to ensure all credit is reported accurately.

All collection debt must have proof of active payment plans or be paid in full. Judgments for money must be satisfied. Visit Wisconsin Circuit Court Access to view public records. Bankruptcy or foreclosure must have been satisfied for at least 12 months.

Applicants must be willing to work in partnership with Fox Cities Habitat’s team and maintain a positive and active involvement in the Homebuyer Sweat Equity program. Accommodations for health and employment concerns will be made on a case-by-case basis.

Applicants must be willing to complete 200 to 400 hours of sweat equity by:

Working at a construction site

Attending classes and workshops

Volunteering at the Appleton ReStore

Participating in Fox Cities Habitat or Appleton ReStore events

If you’re concerned your existing home has your family living in an unsafe environment, Fox Cities Habitat offers a Home Repair Program.

Designed to address issues such as lead paint or mold removal, leaky roof repair, bad plumbing, faulty wiring, or emerging hazards that potentially compromise safety, Fox Cities Habitat can help.